It's good to talk

Wednesday 13th of May 2020

While, for many, discussions about money can be extremely uncomfortable, experts have long stressed the best approach to financial issues is invariably to talk about them. Indeed, perceived wisdom suggests the more open and honest people are about money, the better their life and relationships tend to be.

Finance: the last taboo

There’s a wide variety of reasons why people don’t like to discuss their finances. In some cases, money is simply viewed as a vulgar subject to talk about, while many individuals lack financial confidence and therefo...

Protect yourself and your family in 2020

Thursday 30th of April 2020

While most of us don’t go through life expecting something bad to happen, the truth is that we never know what’s around the corner. Why not make 2020 the

year you put plans in place to safeguard yourself, your family and your home, so that you know you’re protected against life’s unexpected events?

When to take out protection cover

Most people look into buying a Life Insurance, Critical Illness or Income Protection policy following a significant life event: buying a home, getting married or having children.

Before taking out a policy, ho...

It’s time to think about life insurance

Friday 24th of April 2020

If you have dependents – people who rely on you financially – then you should have life insurance. In fact, if you have dependents and don’t have life insurance, you are exposing them to grave financial risk. And who would want to do that?

Life insurance tends not to feature on ‘to do’ lists because it makes us confront uncomfortable questions, such as what would happen to our loved ones if we were to die unexpectedly in the next few years.

However, we all carry a deep responsibility to ensure those we leave behind at least have sufficient...

Spotlight on Enterprise Investment Schemes and Venture Capital Trusts

Friday 24th of April 2020

Complex tax-efficient investments such as Enterprise Investment Schemes (EIS) and Venture Capital Trusts (VCT) are a consideration for those who may be able to tolerate a high level of investment risk.

EIS and VCT are investment vehicles which encourage investment in small, unquoted trading companies in their early stages, who are typically trying to raise capital. These initiatives benefit the economy by promoting innovation amongst the small higher-risk business community, which in turn drives productivity, creates jobs and boosts economi...

What is cashflow modelling?

Wednesday 22nd of April 2020

“In this world nothing can be said to be certain, except death and taxes.”

Financial planning is all about preparing for those things that may not be so certain (and taxes). Plans should be reviewed regularly so they adapt to changes in your circumstances and reflect developments in the wider economy and financial markets.

Cashflow modelling, sometimes known as cashflow forecasting takes a view of investments, debts, income and expenditure. It takes in to account things like inflation, changes in income and interest rates.

It can then be ...

Think Twice Before Cancelling Your Protection Policies

Thursday 9th of April 2020

Life Insurance: It’s not for you, it’s for them! Life insurance is for your loved ones to make sure there is a roof over their heads and food on their table. It’s to ensure that they can continue to do the things in life you’d want them to, if the worst happened and you weren’t around.

You would want to be covered in the unlikely event that you were to die from COVID-19.

The cost of life insurance rises as you get older, so retaining your existing policy will help ensure you benefit from, in most cases, a lower monthly premium than you...

The importance of staying protected

Wednesday 1st of April 2020

Coronavirus is having a huge impact on all of our lives and, it goes without saying, that this must be a very unsettling time for everyone. Not surprisingly, we've received a number of queries from our clients in relation to protection cover and claims which I have made every effort to provide answers to in the following Q&A section.

Am I still covered? Providing you have paid your monthly premiums with your insurer, the cover we arranged remains in place and the terms of it are unaffected by the Coronavirus outbreak. If you have missed any...

Investor Update 30 March 2020

Monday 30th of March 2020

First of all, in this difficult time, we hope that you and your family are well and continuing to manage through this extraordinary and tough period.

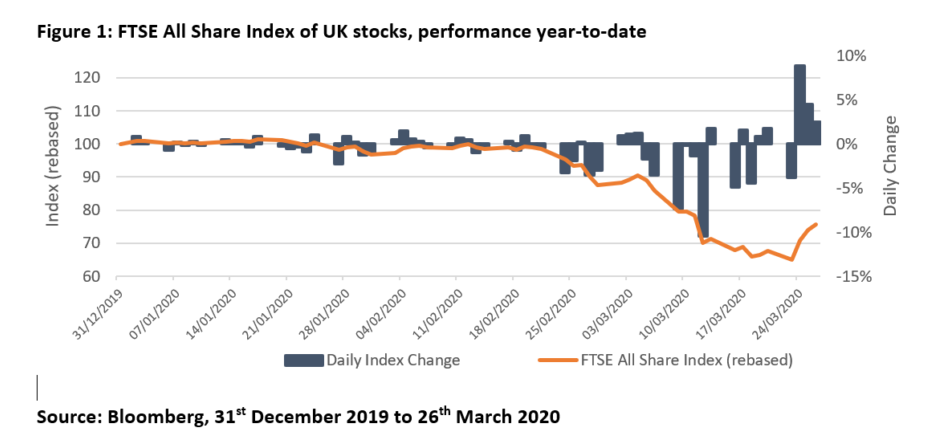

We continue to see significant volatility in global equity markets with large daily falls and gains seemingly now the norm. With this in mind, it is really important that you think twice before taking any action over your pensions and investments.

In fact, last week (to 27 March 2020), the US equity market entered a new “bull” period (this happens when there has been a 20% rally from a pr...

The Outlook Is Improving

Saturday 28th of March 2020

In recent weeks, investors may have become accustomed to seeing markets lurch lower day by day. The gains made this week – by some measures the strongest since 1931 – are therefore particularly welcome. While it is too early to sound the all clear, and while we would caution against attempts to ‘call the bottom of the market’, we believe the outlook is improving. Consequently, at current levels, we see compelling opportunities for longer-term investors in stock markets.

As previously explained (see ‘There Is A Path Out Of This’), we hav...

Government announces three-month mortgage holiday in Covid-19 package

Thursday 19th of March 2020

You may be aware that on March 17, Chancellor Rishi Sunak confirmed that anyone struggling financially as a result of the Coronavirus outbreak will be able to take a three-month mortgage repayment holiday.

A number of lenders had already announced repayment holidays for those affected by Covid-19, but the Government's announcement means ALL lenders will now have to honour the three-month time frame.

A mortgage payment holiday is an agreement you will need make with your lender allowing you to temporarily stop or reduce your monthly mortgag...